Executive Summary

This phase applied rigorous scoring models to move beyond self-reported data. The results reveal a significant gap between "Green Intent" and "Operational Readiness".

We found NO STATISTICAL DIFFERENCE in performance between women, remote (3T) regions, or disability groups. The barriers are structural to the sector, not specific to demographics. The entire ecosystem is early-stage.

While 70% identify as "Green Businesses", only ~10% have the basic operational maturity (SOPs, Records, Legal) to handle commercial finance. There is a "Missing Middle" of readiness.

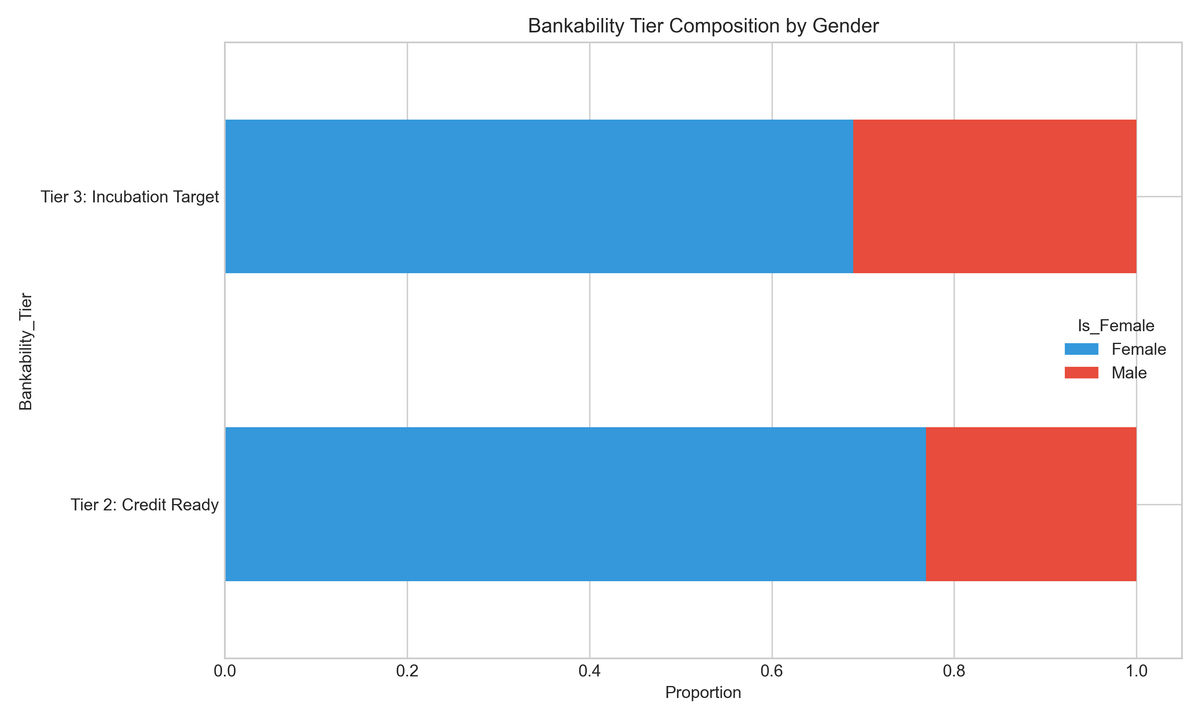

Bankability Segmentation Model

We segmented respondents into three tiers based on Legal Status, Financial Records, and Green Score.

Figure 1: Bankability Tiers by Gender (Stacked)

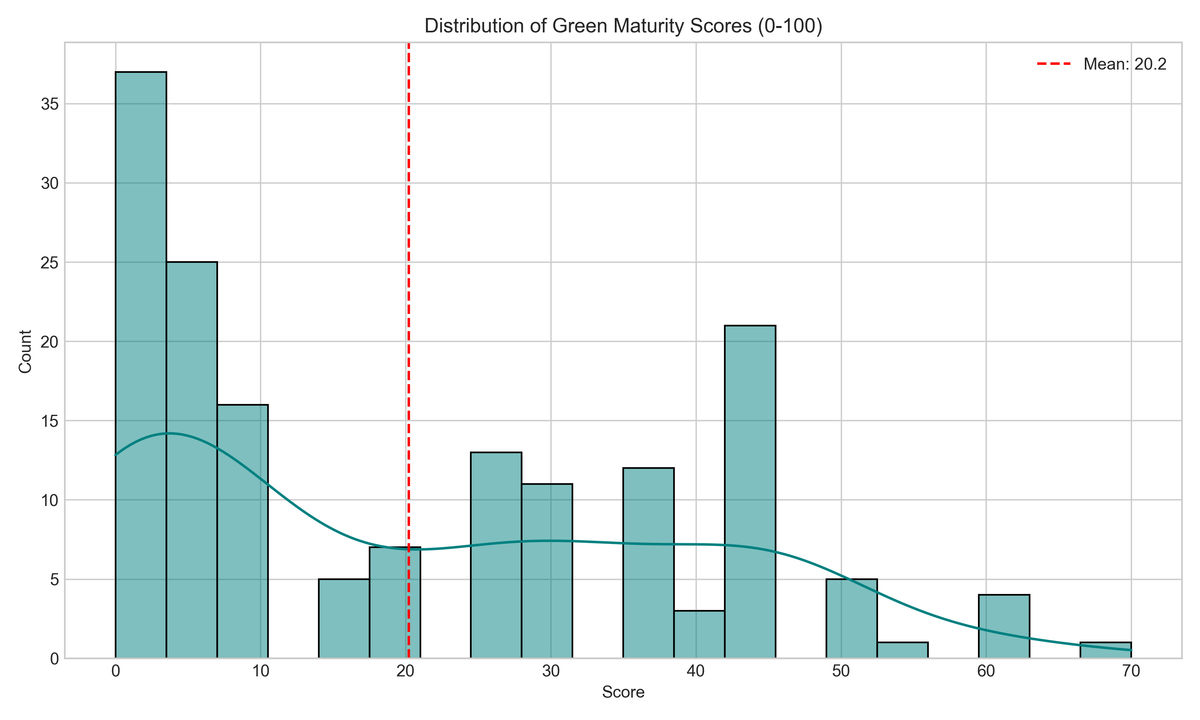

Figure 2: Distribution of Green Maturity Scores (0-100)

Tier Definitions

| Tier Name | Definitions | Share of Pop. |

|---|---|---|

| Tier 1: Investment Ready | Formal Entity + Audited/App Records + Green Score > 60 | 0.0% |

| Tier 2: Credit Ready | Some Legality + Records + Green Score > 40 | 8.1% |

| Tier 3: Incubation Target | Informal, No SOPs, Low Records | 91.9% |

Statistical Hypothesis Testing

We ran rigorous tests to see if observed differences were real or due to chance.

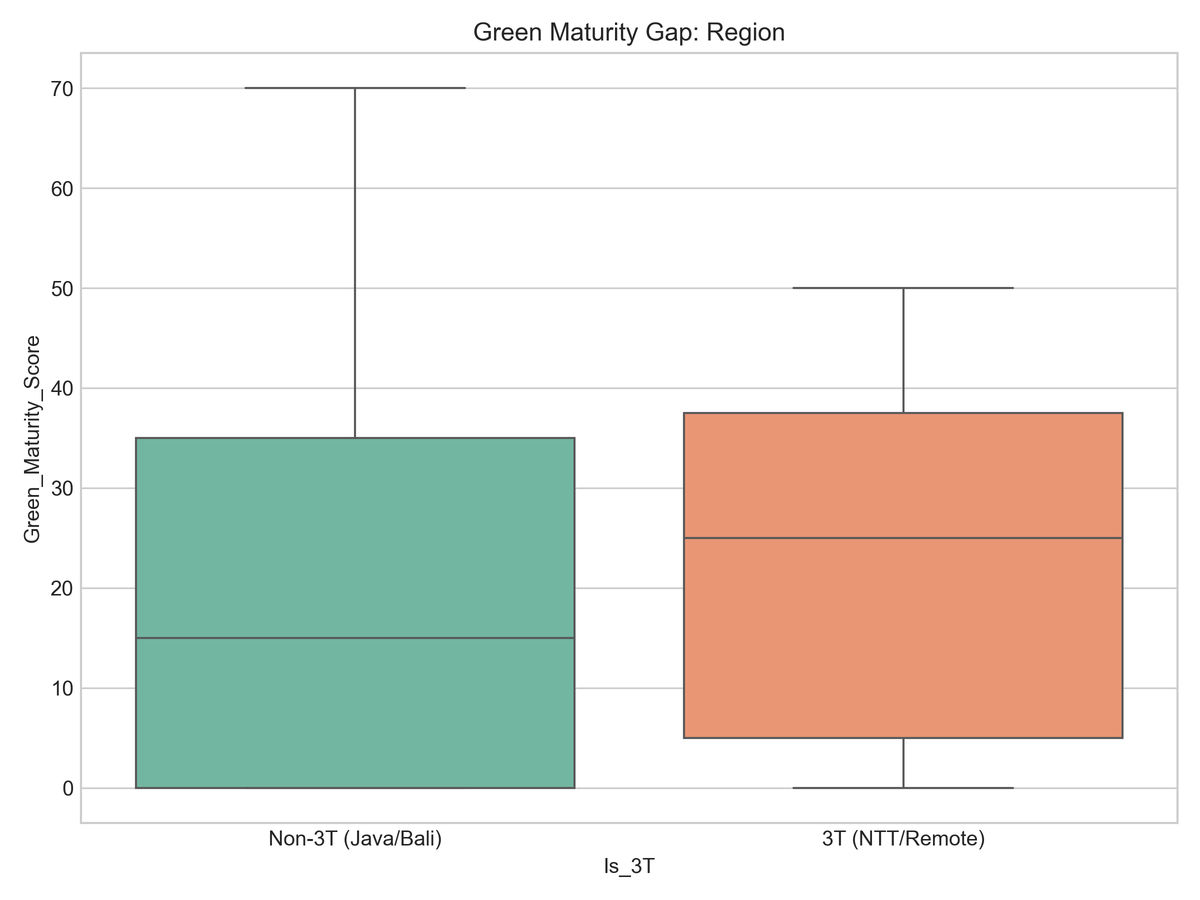

Figure 3: Green Maturity Gap (Java vs 3T)

| Hypothesis Test | Groups Compared | P-Value | Conclusion |

|---|---|---|---|

| Gender Gap (T-Test) | Male vs Female Green Scores | 0.61 | No Difference (Equal Performance) |

| Regional Gap (T-Test) | Java/Bali vs 3T Regions | 0.41 | No Difference (Equal Performance) |

| Inclusion Gap (Chi-Square) | Disability vs Bankability Tier | 0.42 | No Difference (Equal Access) |

Interpretation: The "P-Values" are all > 0.05, meaning we cannot claim any group is "worse" than another. This suggests that interventions should be universal rather than segmented by ability/gender, though delivery methods must remain accessible.

Recommendations for Main Report (BAB 6)

1. Program Design: "Green Fundamentals"

Since Green Maturity scores are low (~20/100), the incubation curriculum must start with basics, not advanced tech.

- Module 1: "Simple Green SOPs" (How to write them)

- Module 2: "From Cash to Accrual" (Bookkeeping Apps)

- Module 3: "Legal Literacy" (Getting an NIB)

2. Financial Product: "The Bridge Grant"

Commercial loans (Tier 1/2) won't work for 92% of the market (Tier 3). We need a "Bridge Grant" product.

- Value: Small amounts (e.g., Rp 5jt - 10jt)

- Usage: Strictly for Legal Registration costs or Buying Basic Green Tools (Composters).

- Goal: Move them from Tier 3 -> Tier 2.

3. Policy: "Step-Ladder Certification"

Existing certifications are too hard. Create a "Bronze/Silver/Gold" ladder so early-stage UMKM can get recognized for small steps (like sorting waste).