Project Overview

Research Focus

This comprehensive analysis examines UMKM (Micro, Small, and Medium Enterprises) across Indonesia, focusing on sustainability practices, financing needs, and business development challenges.

Core Research Areas

- Business Characteristics: Types, sectors, legal status, and employee distribution

- Sustainability Practices: Green business identification, energy usage, waste management

- Financing & Credit: Credit history, green financing interest, barriers

- Training & Development: Participation rates, preferred formats, needs

- Inclusion & Accessibility: Disability considerations, gender barriers

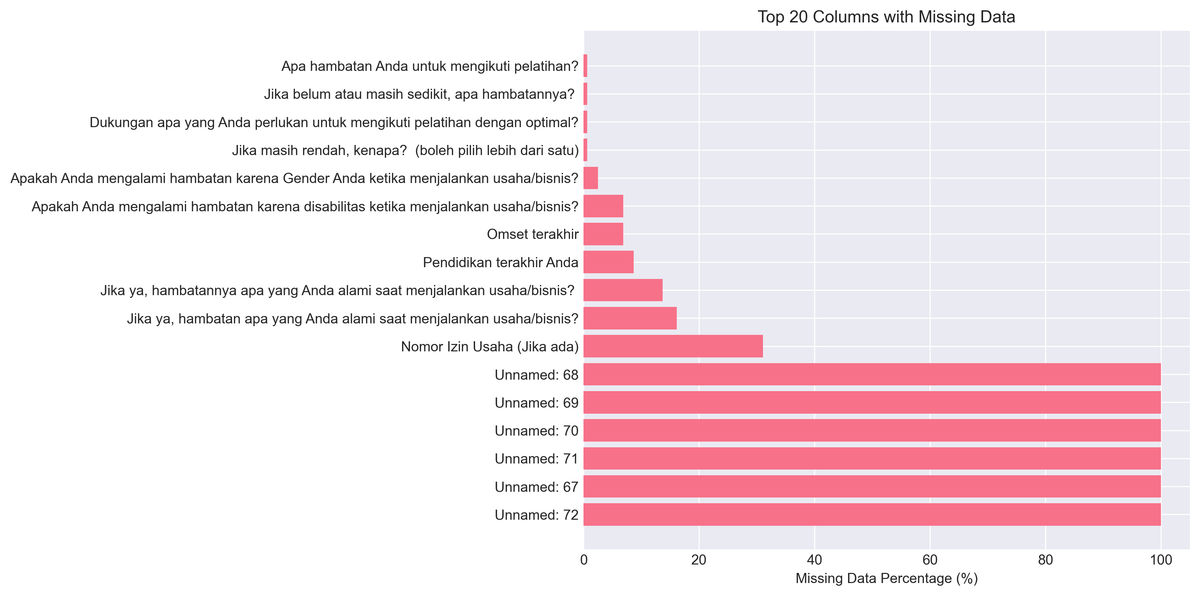

Data Overview

| Metric | Value |

|---|---|

| Sample Size | 161 respondents |

| Variables | 73 survey questions |

| Missing Data | 9.43% overall |

| Geographic Focus | Primarily Java region |

| Study Period | 2025 survey collection |

Key Findings

Demographics

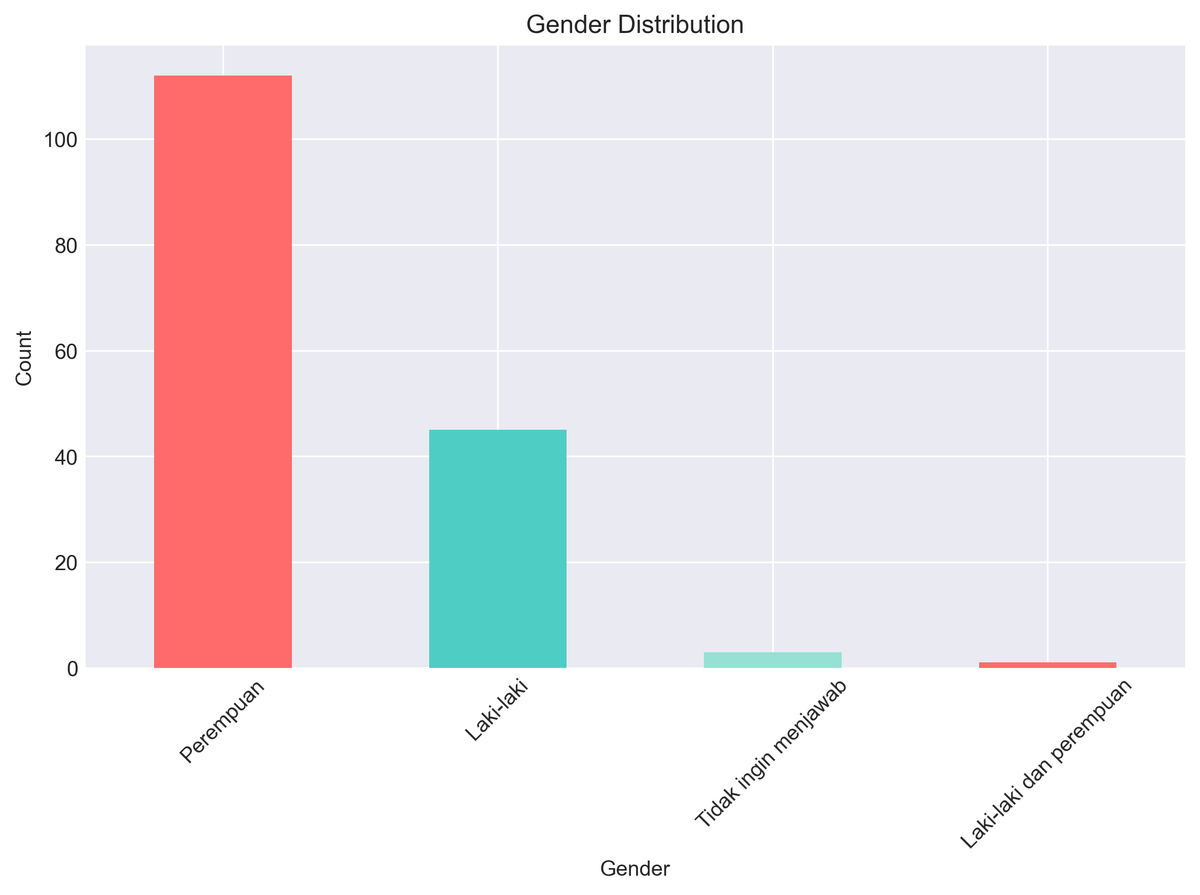

- Gender: 69.6% of respondents are female entrepreneurs.

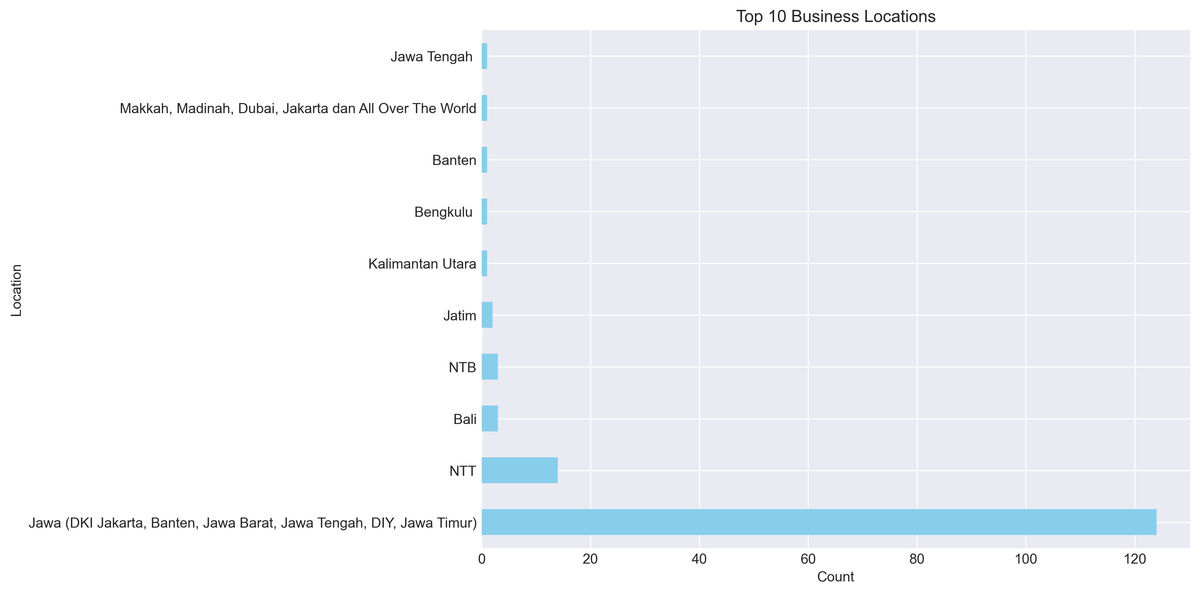

- Primary Location: Concentrated in Java (DKI Jakarta, Banten, Jawa Barat, Jawa Tengah, DIY, Jawa Timur).

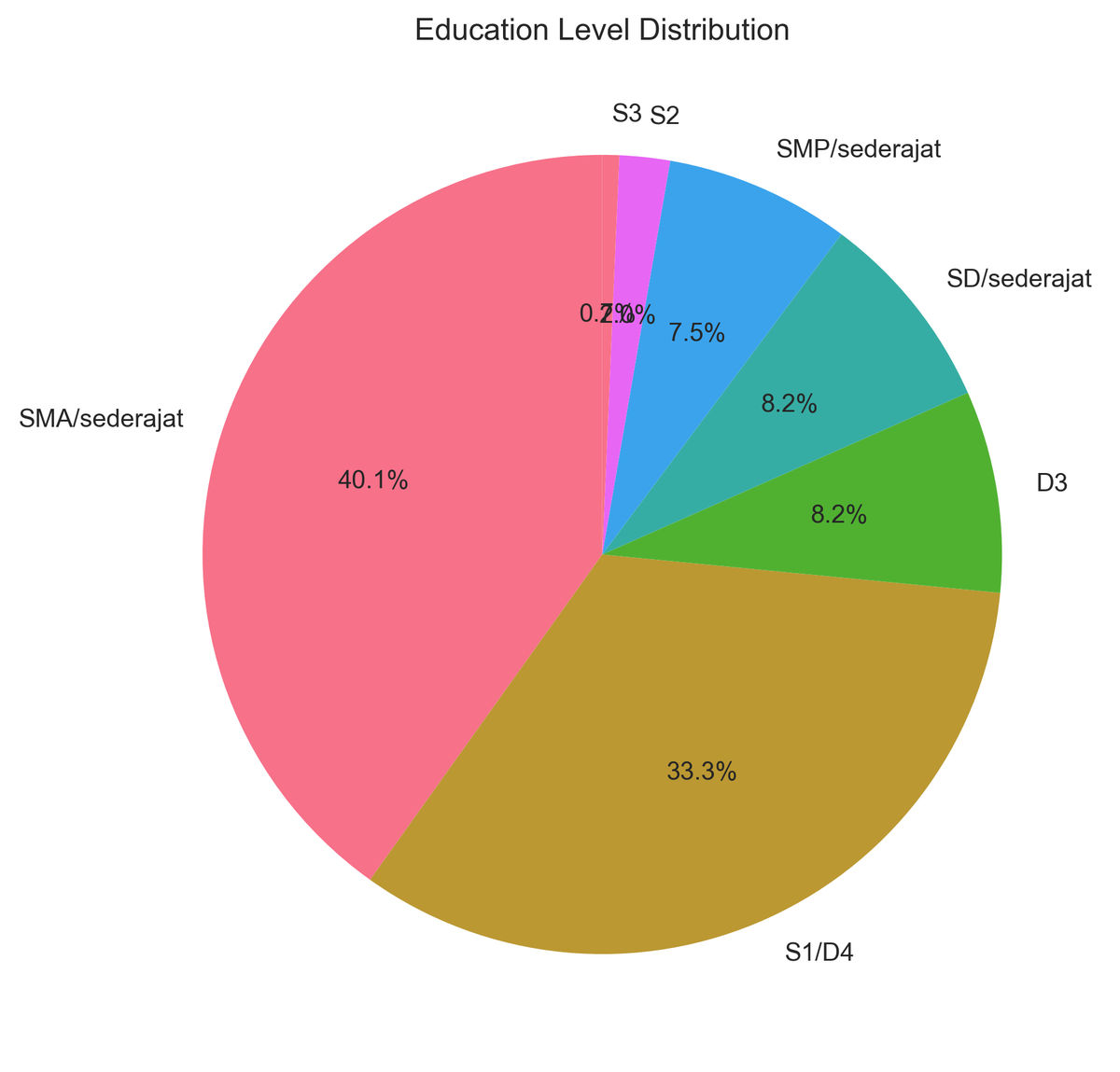

- Education: Diverse educational background ranging from high school to postgraduate levels.

Business Characteristics

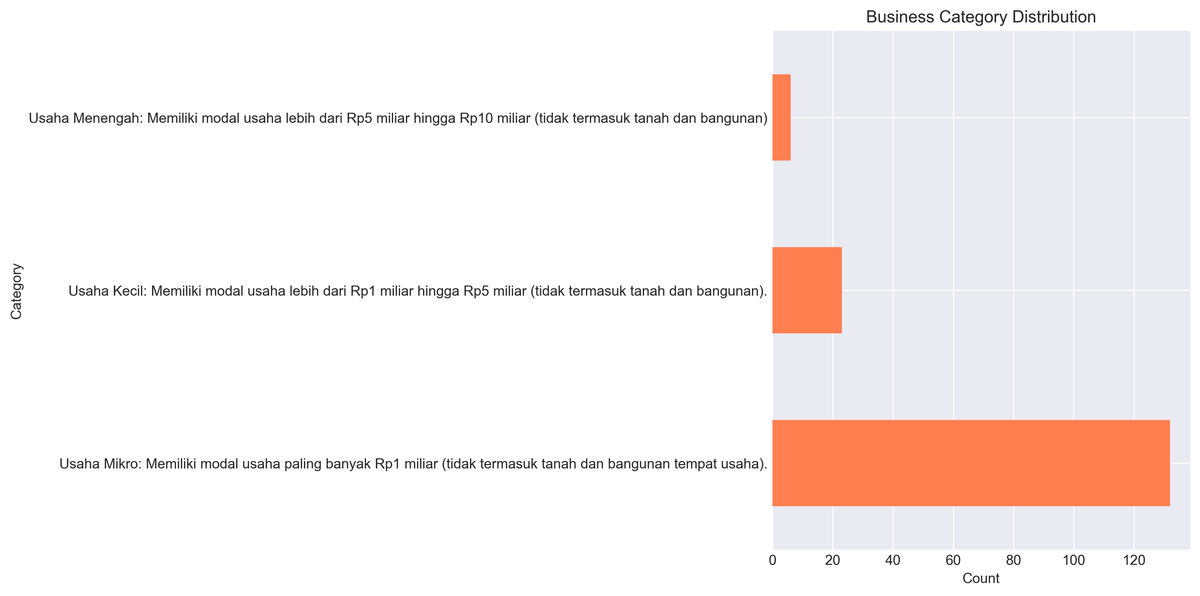

- Dominant Scale: Micro enterprises (Usaha Mikro) form the majority.

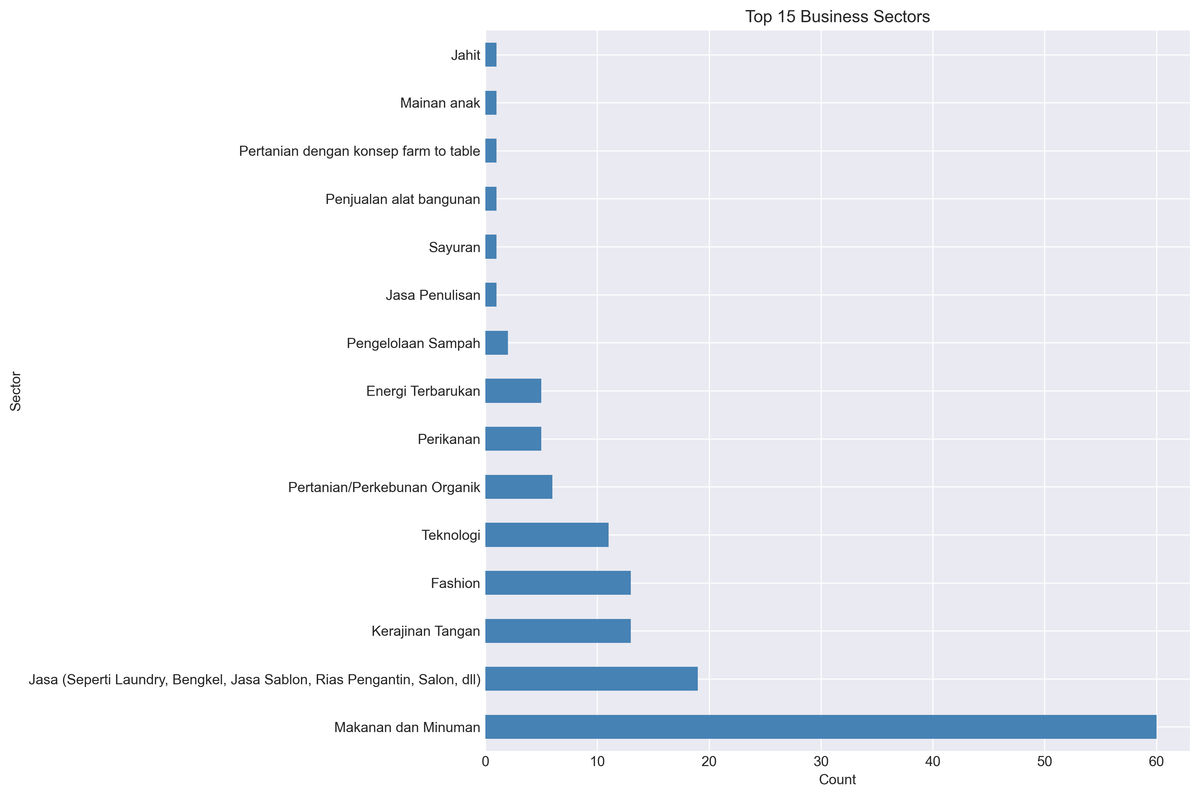

- Top Sector: Food & Beverage leads with 44 businesses (27.3%).

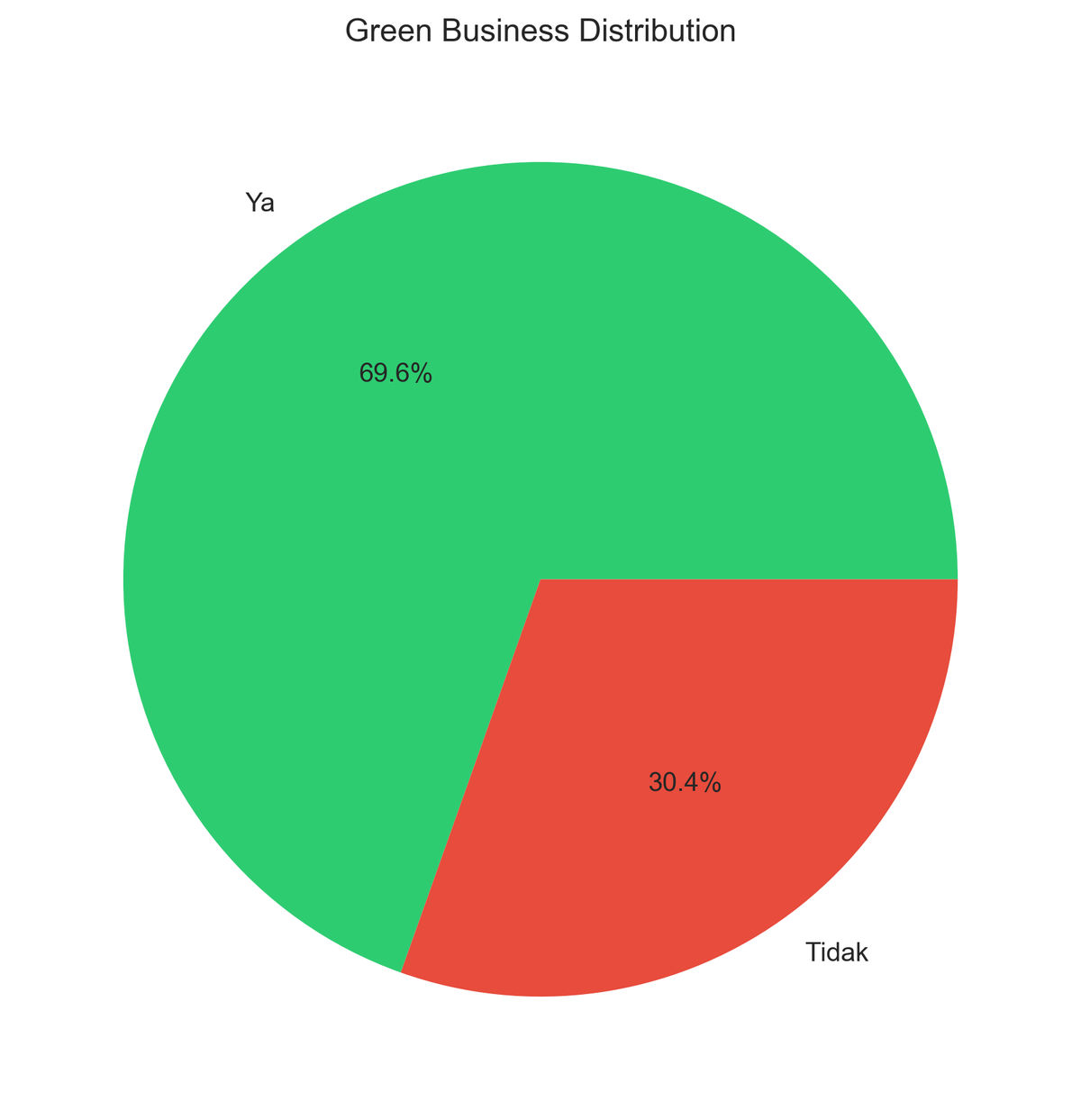

- Green Identity: 69.6% identify as green businesses.

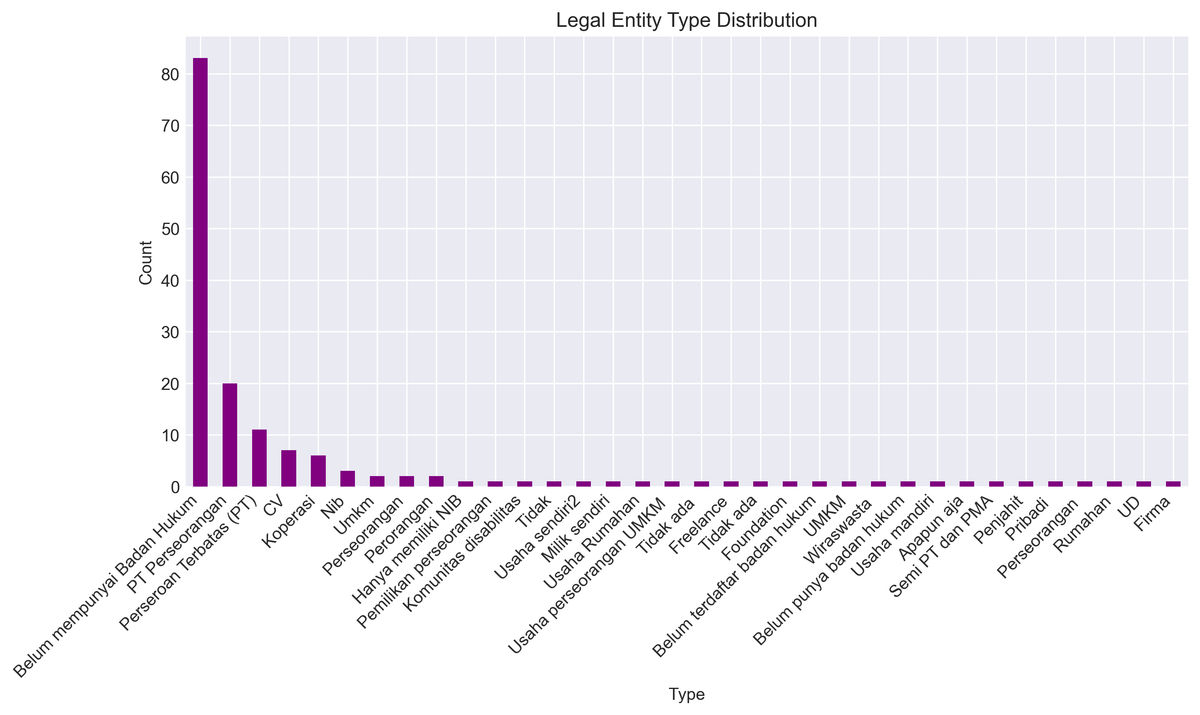

- Legality: A significant portion operates without formal legal entity registration.

Sustainability Practices

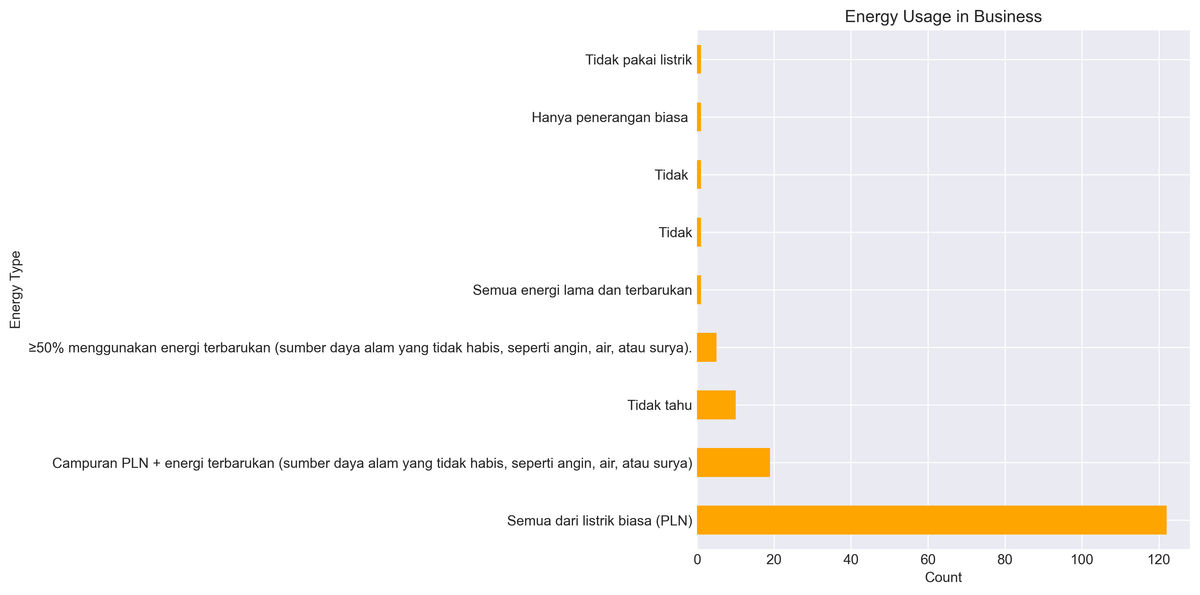

- Energy Source: 75.8% rely solely on conventional electricity (PLN).

- Renewables: Limited adoption, with only 11.8% using mixed or renewable sources.

- Waste Management: 30.4% report no active waste management practices.

- Packaging: 33.5% do not use eco-friendly packaging solutions.

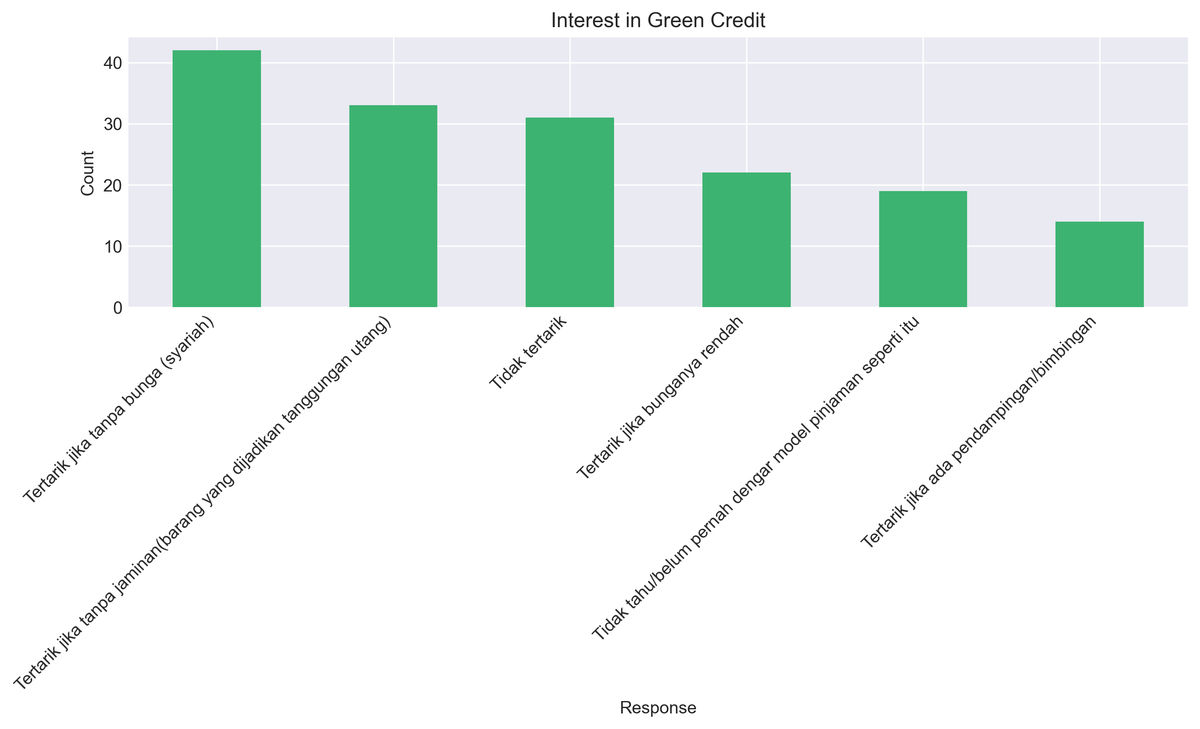

Financing Insights

- Credit Access: 59.0% have never accessed business loans.

- Syariah Preference: 26.1% express interest specifically in syariah-based (interest-free) plans.

- Collateral Issues: 20.5% are interested only if collateral requirements are waived.

- Disinterest: 19.3% show no interest in green credit options.

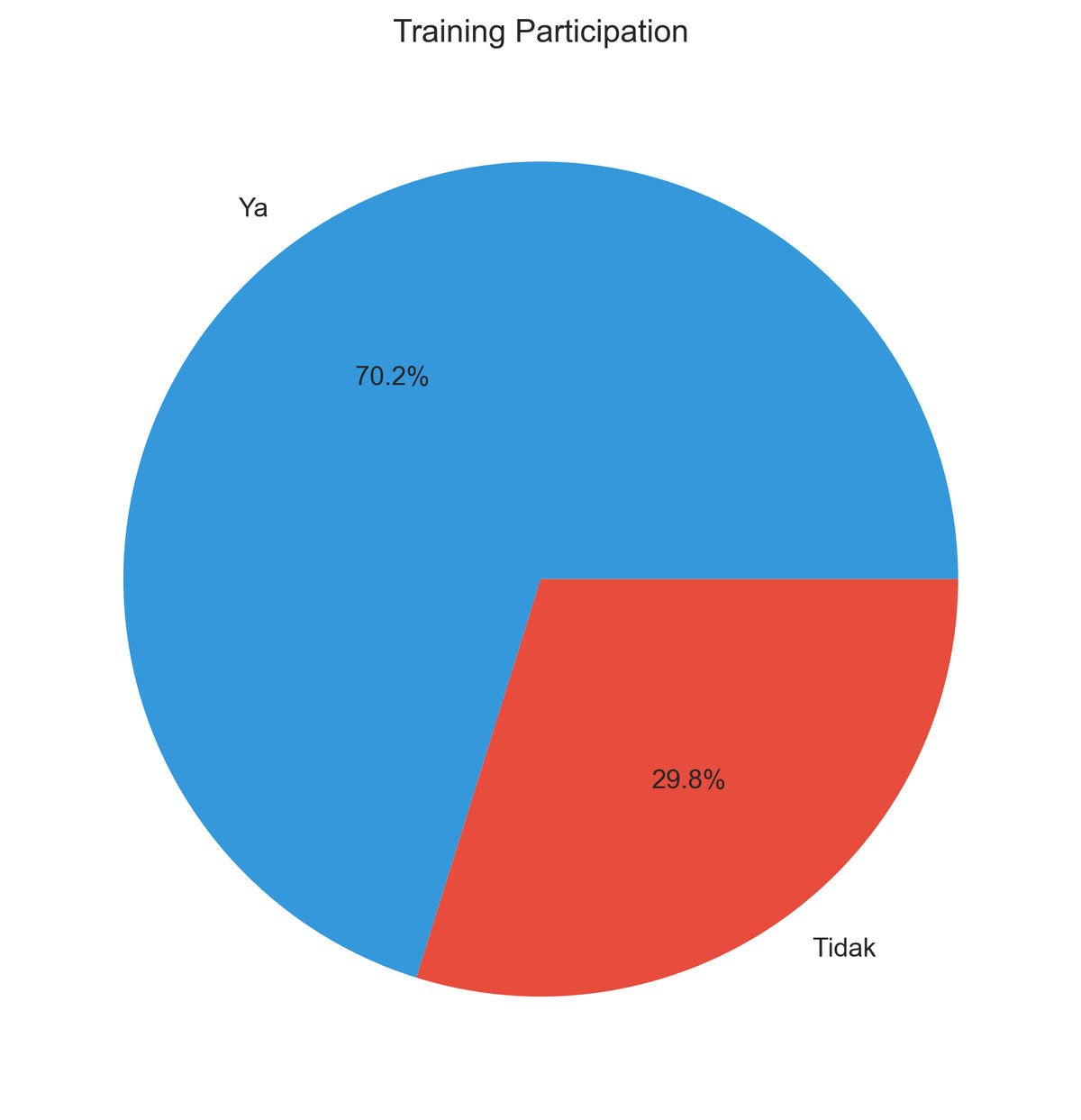

Training & Development

- Engagement: 70.2% have participated in training programs.

- Format Preference: Strong preference for hands-on, practical learning.

- Barriers: Location distance, time constraints, and technology access are key hurdles.

Inclusion Challenges

- Gender Barriers: 30.4% report gender-related challenges in business.

- Disabilities: 16.1% of entrepreneurs have physical limitations.

- Detailed Needs: Issues with mobility (26), emotional/mental health (6), vision (6), and cognitive (3) cited.

Data Visualizations

The following visualizations illustrate distributions and patterns identified during the analysis.

Figure 1: Gender Distribution of Respondents

Figure 2: Business Category Distribution

Figure 3: Top 15 Business Sectors

Figure 4: Education Level Distribution

Figure 5: Top 10 Business Locations

Figure 6: Green vs Conventional Business

Figure 7: Legal Entity Types

Figure 8: Energy Usage Patterns

Figure 9: Interest in Green Credit Financing

Figure 10: Training Participation Rates

Figure 11: Missing Data Analysis

Policy Recommendations

1. Green Transition Support

- Provide targeted subsidies for renewable energy adoption.

- Offer specialized training on sustainable business practices.

- Establish green certification programs for credibility.

- Develop sector-specific sustainability guidelines.

2. Accessible Financing

- Develop syariah-compliant green credit products.

- Reduce or eliminate collateral requirements for micro-enterprises.

- Simplify loan application processes.

- Provide financial literacy training alongside credit products.

- Create alternative credit scoring mechanisms based on business activity.

3. Capacity Building

- Increase availability of hands-on practical training programs.

- Decentralize training to bring it closer to communities.

- Improve digital literacy initiatives for modern business tools.

- Develop sector-specific training curricula.

- Provide follow-up mentorship programs to ensure application of learning.

4. Inclusion Enhancement

- Address gender-based barriers through targeted support programs.

- Ensure business support services are disability-accessible.

- Provide assistive technologies and necessary accommodations.

- Create inclusive mentorship networks.

- Develop awareness campaigns on inclusive business practices.

5. Business Formalization Support

- Assist with legal entity registration procedures.

- Simplify bureaucratic processes for small businesses.

- Provide one-on-one business licensing support.

- Offer tax compliance guidance and incentives.

- Establish one-stop service centers for administrative needs.

Next Steps for Implementation

Research Methodology

Data Collection

Survey data was collected from 161 UMKM businesses across Indonesia during 2025. The survey instrument comprised 73 comprehensive questions covering business operations, sustainability practices, financing needs, and demographic information.

Analysis Approach

The exploratory data analysis was conducted using Python, utilizing the standard data science stack:

Analysis Modules

- Data Quality Assessment: Missing data analysis and completeness metrics.

- Descriptive Statistics: Frequencies, distributions, and central tendencies.

- Demographic Analysis: Gender, age, location, and education patterns.

- Business Profiling: Sectors, categories, legal status, and size metrics.

- Sustainability Assessment: Energy, waste, packaging, and green practices.

- Financing Analysis: Credit access, barriers, and preferences.

- Training Evaluation: Participation, formats, and effectiveness.

- Inclusion Analysis: Disability, gender, and accessibility barriers.

Visualization Standards

All visualizations adhere to publication-ready standards:

- 300 DPI resolution for print quality.

- Consistent color palette using seaborn "husl".

- Clear labels, legends, and titles.

- Accessible color schemes for readability.

Project Structure

Data Quality Metrics

| Quality Metric | Result |

|---|---|

| Overall Missing Data | 9.43% |

| Complete Records | 161 respondents |

| Valid Response Rate | 90.57% |

Reproducibility

The analysis is fully reproducible. To regenerate all outputs, execute the following:

All scripts, data, and documentation are version-controlled and available in the project repository.